Why Carbon Credit Additionality is More Important Than Ever

The voluntary carbon market (VCM) is evolving. As it does, the world is increasingly recognizing that not all carbon credits are created equal. More than ever, carbon credit buyers in particular are concerned with one basic question: Are the carbon credits real?

One attribute especially drives the yes/no answer to that question: additionality.

When it comes to carbon credits and the emissions avoidance, reduction, or capture that generates them, additionality asks whether “the mitigation activity would not have taken place in the absence of the incentive created by the carbon credits,” note Environmental Defense Fund, WWF, and Oeko-Institute in their carbon credit guidance for buyers.

In other words: Would the associated activity have happened anyway? Or did the carbon credit itself help drive measures that resulted in new changes to the global emissions balance?

The challenge of assessing additionality

At first glance, determining additionality might seem easy and straightforward. In practice, for most carbon projects, additionality is exceptionally hard to assess.

This is due to the fundamental challenge that only the project developer can know whether a project is truly additional. Only they know whether the carbon credit revenue enabled project implementation or expansion, vs. the project proceeding regardless of associated carbon credits. For many projects, these insights are essentially unknowable to anyone else.

In practice, because additionality is difficult to assess, many projects that would have gone forward anyway are still compensated with carbon credits. For example, take the case of ‘passive’ projects such as avoided (i.e., prevented) deforestation. These projects must somehow, through a standardized methodology, test whether a landowner plans to cut down the trees — and then confirm that carbon credit revenue stops them from doing so.

This test often fails and credits are issued for a forest that would not have been cut down in any case. This miscalculation results in the undermining of trust in the VCM, misallocated climate funds, unfair outcomes, and, worst of all, no contribution to solving the climate crisis - all because the lack of additionality boils down to hollow carbon credits that aren't real.

ZeroSix and additionality

ZeroSix carbon credits, by contrast, are ‘additional by design’. Let us explain.

We aim to reduce global emissions by shutting in oil and gas from the most polluting wells in the U.S. The shut-in reserves are converted to carbon credits following a strict protocol. This incentivizes the early retirement of the most-polluting, least-efficient wells, while transforming the remaining, unextracted oil and gas into a climate-friendly asset.

A core part of the protocol is its additionality test. Projects that wish to participate in ZeroSix face a three-pronged screen: 1) a regulatory test, 2) a common practice test, and 3) an implementation barrier test. Both reserve reporting (how much fossil fuel is still in the ground) and economic viability (how likely is it that the fossil reserves will be extracted) are central to these screens as tests of additionality.

Only those underground fossil reserves for which it is currently profitable to extract hydrocarbons and for which there is near certainty that they will be extracted in the future are eligible to be shut in and converted to high-quality carbon credits.

How we calculate reserves

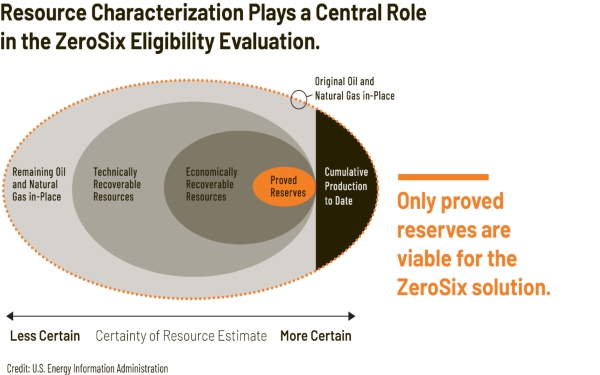

The basis for our additionality calculation is the SEC-regulated reserve reporting standard (defined here and here). These reports estimate the conservative recoverable reserves and the time period over which the reserves can be retrieved.

Reserve reports play a key role in the valuation of a hydrocarbon-focused company and help investors assess its financial health. Publicly traded oil and gas companies must file reserve reports annually and an independent auditor assesses each report.

Within a reserves report, a distinction is made between three types of reserves:

● Proved reserves: have a 90+% chance of profitable extraction;

● Probable reserves: have a 50–90% chance of profitable extraction; and

● Possible reserves: have a 10–50% chance of profitable extraction.

We can further break down proved reserves into three subcategories:

● Proved developed reserves (PDP): reserves that are economically viable and are actively producing;

● Proved developed non-producing reserves (PDNP): reserves with an existing well-bore and identified reserves that are not producing; and

● Proved undeveloped (PUD) reserves: reserves for which a new well-bore is required and, thus, requires new investment.

Only PDP reserves and a very specific, small subset of PDNP reserves are eligible for generating ZeroSix carbon tokens.

How ZeroSix creates an incentive to keep reserves in the ground

In the absence of a counter-incentive or a legal impediment, extracting hydrocarbons from proved developed reserves is, by definition, profitable and feasible — and therefore, likely to continue, counter to what’s needed for a net-zero aligned future.

In the case of proved developed reserves, the investments have already been made, production is already happening (via extraction and refining), and continued operation is profitable. From an oil-and-gas industry perspective, a proved developed reserve and associated producing well is essentially money coming out of a hole in the ground. Without an incentive, producers will not close off the flow of money.

By focusing on proved developed (producing) reserves as a central piece of our additionality criteria, ZeroSix is taking reserves that would be extracted with near certainty and is permanently shutting them in, creating high-quality carbon credits in the process.

And by applying rigorous, regulatory-backed standards to quantifying those abandoned reserves, we’re able to confidently determine how many carbon credits should be issued.

In the absence of the ZeroSix carbon credit mechanism, business as usual would, by definition, continue — resulting in decades of associated GHG emissions from fossil fuels the world can’t afford to extract, refine, and combust. The purchase of ZeroSix credits keeps fossil fuels in the ground, unextracted and unburned — a guarantee that carbon credit buyers are directly contributing to a net–zero world.

Learn more about the ZeroSix approach and what makes us a high-quality carbon credit.