Three-quarters of a century ago, De Beers captured the world’s imagination with their new and since-legendary slogan, “a diamond is forever.” (Diamonds, coincidentally, are 99.95% pure carbon.) That same focus on lasting forever can and must apply to carbon credits, too.

Carbon dioxide (CO2) emissions are long-lived, persisting in the atmosphere for 300 to 1,000 years. Other more-potent but shorter-lived greenhouse gases (GHGs) — such as methane — still have an atmospheric lifespan of more than a decade and, importantly, do their climate damage in the near future during this critical moment when the global economy needs to decarbonize rapidly.

In the parlance of carbon markets, this concept is known as “permanence” — the sustained, long-term performance of a GHG abatement project with no reversals that undermine its associated carbon credits. Although virtually all projects have measures in place to ensure permanence, in practice not all projects meet this promise.[1]

Here at ZeroSix, we aim to reduce global emissions by shutting in oil and gas from the most polluting wells in the U.S. The shut-in reserves are converted to carbon credits following a strict protocol. This incentivizes the early retirement of the most-polluting, least-efficient wells while transforming the remaining, unextracted oil and gas into a climate-friendly asset. The ZeroSix protocol focuses on proved, producing oil and gas reserves — a criteria that helps ensure that ZeroSix carbon credits are additional.

For these resources, the investments have already been made, production is already happening (via extraction and refining), and continued operation is profitable. Thus shutting in those fossil fuel reserves is a shift from business usual and meets the standard of additionality for new emissions reductions or avoided emissions.

On top of that additionality, permanence in this context means permanently plugging and abandoning (P&A) a gas or oil well. As defined by our protocol, this is an irreversible action that shuts in hydrocarbons and their associated emissions forever. The permanence of ZeroSix carbon credits is legally guaranteed for at least 50 years. In reality, once the well has been properly decommissioned, the oil and gas will remain trapped in the subsurface reservoir indefinitely, where it has already been for millions of years.

Three pillars of “permanence protection” cover ZeroSix carbon credits: (i) geological, (ii) legal, and (iii) operational. Each of the three pillars is independently verified or established by a third party. On top of that, a buffer account provides an additional layer of permanence insurance.

1. Geological

The plugging and abandonment process starts with an assessment of the geologic structure of the project reservoir and the performance history of the well or wells within a project.[2]

At the start of a ZeroSix project, the project owner provides documentation substantiating the project boundaries, lease boundaries, an inventory, and status of the wells within and outside the project boundaries. In other words, the project owner demonstrates internal (wells, reservoirs, maintenance history) and external (seismic activity, reservoirs outside the project boundaries) aspects of the project. A proper assessment of the geologic structure helps ensure the assessment permanence of the project.

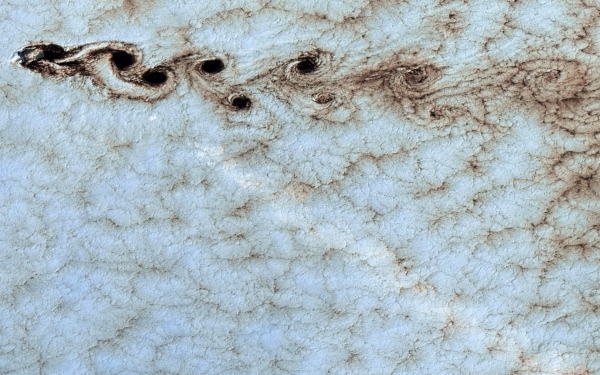

Part of this mapping is documentation to prove the absence of “subsurface connectivity.” Oil and gas is extracted from reserves through wellbores and wellheads. Typically, multiple wells are connected to one reservoir. In some cases, reservoirs are connected to each other (i.e., there is subsurface connectivity) or are in “communication,” allowing hydrocarbons from one reservoir to flow to another.

To ensure permanence and prevent leakage, only projects that shut in all connected wells are eligible for a ZeroSix carbon credit project.[3] Geologic permanence is an assurance of an isolated volume of hydrocarbons within the project boundaries, that — without dedicated efforts from an operator — would remain in place for millions of years.

Project developers submit the information to the ZeroSix platform, which is consequently independently verified by a third-party verifier.

2. Operational

The operational permanence protection refers to the physical plugging and abandonment of wells. The operational execution is informed by the geological assessment.

The P&A process starts by filing permits with the regulatory authorities. These submissions must include a detailed plan, such as measures to protect subsurface groundwater, clean up of contamination at the surface around the wellhead, removal of surface equipment, and the return of the well site to its natural state.

Once plugged, recovering hydrocarbons from a reservoir becomes technically extremely difficult -if not impossible- and definitely economically unviable.

With the permit in place, the actual plugging of the well can commence. A producing oil or gas well has a wellhead connected to a pump, through which hydrocarbons are extracted from the earth. The plugging process involves the removal of the wellhead and use of cement plugs to seal the well at several depths. It is an irreversible process designed to prevent methane and subsurface fluids from leaking from an abandoned well.

To confirm the plugging and abandonment, the project developer must submit a report that includes the final measurements of air, soil, and water quality where relevant, clearly validating the permanence of the retired reserves. The report must include the final results of land reclamation success.

Once plugged, recovering hydrocarbons from a reservoir becomes technically extremely difficult (if not impossible) and definitely economically unviable. Additionally, modern plugging and abandonment techniques and regulations make surface or subsurface leaks extremely unlikely. State regulators verify the plugging and abandonment as part of the regular P&A process.

3. Legal

In addition to the operational permanence assessment, the project owner will need to secure a legally binding protection against the future production of the retired resources. This legally prevents any future drilling of new wells to access the retired oil & gas volumes. The contractual limitation has a minimum of 50 years and is bound to the mineral rights and also applies to wells (surface areas) outside the project boundary trying to access the retired oil & gas volumes (subsurface areas) within the project boundary. On top of this, ZeroSix monitors the relevant state regulator databases for any new development permits being issued in proximity of the project area.

Buffer account

On top of the three layers of protection, ZeroSix holds a buffer account that covers unlikely cases of reversals. The buffer account serves as general insurance across all projects. In case of reversals, carbon credits from the buffer account are retired to compensate. This ensures that one (1) ZeroSix carbon credit always equals one (1) tonne of CO2e sequestered.

By buying a ZeroSix carbon credit, one tonne of CO2e will be sequestered for at least 50 years. There are three layers of permanence protection in place — geological, operational, and legal — to ensure this promise, and a buffer account to compensate for the unlikely case of reversals. The three layers of permanence protection and additional general insurance help ensure the high quality of a ZeroSix credit.

-----

[1] The most prevalent instances of reversals typically involve illegal logging or forest fires in projects designed to curtail deforestation.

[2] To be exact, the project owner provides: (i) a wellbore inventory (an overview of the wellbores in the designated and surrounding area), (ii) cross sections of the wellbore (measurements of the wellbore), (iii) wellbore schematics (in simple terms, wellbores are a blueprint of the wells) and (iv) other relevant information such as fluid analysis, well production tests and water salinity (see for a comprehensive list paragraph 2.7.3 of the ZeroSix Production Reserves Carbon Offset Protocol v1).

[3] If only one well would be shut in, oil and gas from the same reservoir could be extracted through a different well connected to the same reservoir. This would result in leakage, as carbon credits would be granted for reserves that are extracted at a later point in time. By shutting in all wells for connected reservoirs ZeroSix prevents leakage.